Journal Entry For Depreciation Expense . the journal entry is used to record depreciation expenses for a particular accounting period and can be recorded. The journal entry for depreciation. learn how to record depreciation expense and accumulated depreciation for different types of fixed. learn how to calculate and record depreciation expense using different methods and journal entries. Depreciation expense is the allocation. learn how to record depreciation expense and accumulated depreciation in the income statement and balance sheet, respectively. learn how to record depreciation expense and accumulated depreciation in the accounting journal. knowing how to record depreciation in a journal entry and calculate it per fixed asset can help you understand how depreciation affects your financial. depreciation expense is recorded to allocate costs to the periods in which an asset is used.

from haipernews.com

depreciation expense is recorded to allocate costs to the periods in which an asset is used. knowing how to record depreciation in a journal entry and calculate it per fixed asset can help you understand how depreciation affects your financial. learn how to record depreciation expense and accumulated depreciation in the income statement and balance sheet, respectively. learn how to record depreciation expense and accumulated depreciation for different types of fixed. learn how to calculate and record depreciation expense using different methods and journal entries. the journal entry is used to record depreciation expenses for a particular accounting period and can be recorded. The journal entry for depreciation. learn how to record depreciation expense and accumulated depreciation in the accounting journal. Depreciation expense is the allocation.

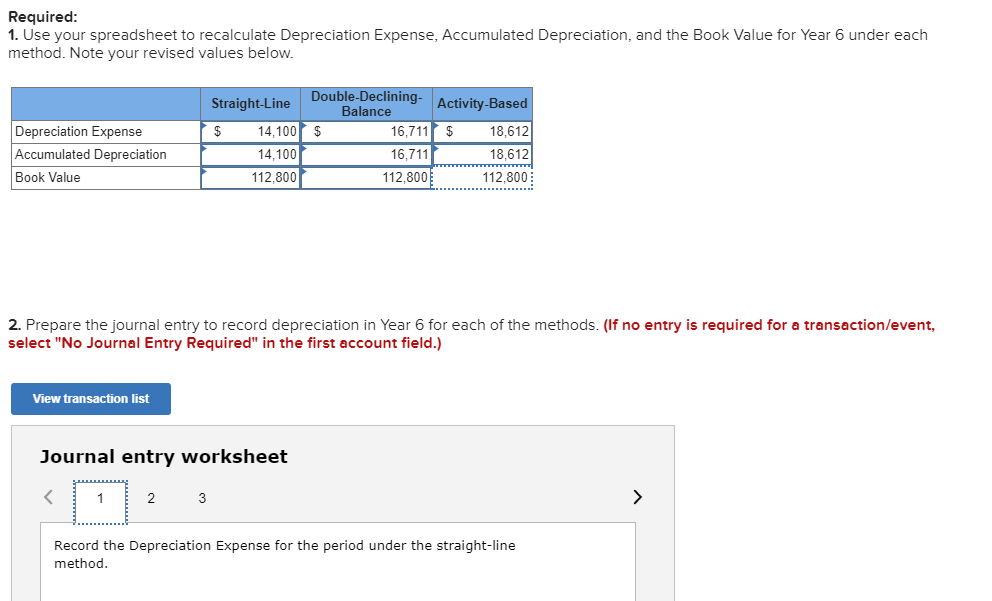

How To Calculate Revised Depreciation Expense Haiper

Journal Entry For Depreciation Expense learn how to record depreciation expense and accumulated depreciation in the accounting journal. learn how to calculate and record depreciation expense using different methods and journal entries. knowing how to record depreciation in a journal entry and calculate it per fixed asset can help you understand how depreciation affects your financial. Depreciation expense is the allocation. learn how to record depreciation expense and accumulated depreciation in the income statement and balance sheet, respectively. depreciation expense is recorded to allocate costs to the periods in which an asset is used. learn how to record depreciation expense and accumulated depreciation for different types of fixed. learn how to record depreciation expense and accumulated depreciation in the accounting journal. the journal entry is used to record depreciation expenses for a particular accounting period and can be recorded. The journal entry for depreciation.

From businessyield.com

DEPRECIATION ACCOUNTING Definition, Methods, Formula & All you should Journal Entry For Depreciation Expense the journal entry is used to record depreciation expenses for a particular accounting period and can be recorded. learn how to record depreciation expense and accumulated depreciation for different types of fixed. knowing how to record depreciation in a journal entry and calculate it per fixed asset can help you understand how depreciation affects your financial. . Journal Entry For Depreciation Expense.

From www.slideshare.net

13.4 Journal entries for depreciation Journal Entry For Depreciation Expense Depreciation expense is the allocation. the journal entry is used to record depreciation expenses for a particular accounting period and can be recorded. learn how to record depreciation expense and accumulated depreciation in the accounting journal. learn how to calculate and record depreciation expense using different methods and journal entries. knowing how to record depreciation in. Journal Entry For Depreciation Expense.

From financialfalconet.com

Adjusting Entry for Depreciation Financial Journal Entry For Depreciation Expense the journal entry is used to record depreciation expenses for a particular accounting period and can be recorded. knowing how to record depreciation in a journal entry and calculate it per fixed asset can help you understand how depreciation affects your financial. learn how to record depreciation expense and accumulated depreciation in the accounting journal. Depreciation expense. Journal Entry For Depreciation Expense.

From www.speakaccounting.com

How to Record Journal Entries for Depreciation With Examples Speak Journal Entry For Depreciation Expense learn how to record depreciation expense and accumulated depreciation for different types of fixed. learn how to calculate and record depreciation expense using different methods and journal entries. learn how to record depreciation expense and accumulated depreciation in the income statement and balance sheet, respectively. depreciation expense is recorded to allocate costs to the periods in. Journal Entry For Depreciation Expense.

From cerelsuz.blob.core.windows.net

The Journal Entry To Record Depreciation Expense Includes (Select All Journal Entry For Depreciation Expense Depreciation expense is the allocation. knowing how to record depreciation in a journal entry and calculate it per fixed asset can help you understand how depreciation affects your financial. learn how to record depreciation expense and accumulated depreciation in the accounting journal. learn how to record depreciation expense and accumulated depreciation in the income statement and balance. Journal Entry For Depreciation Expense.

From www.journalofaccountancy.com

8 ways to calculate depreciation in Excel Journal of Accountancy Journal Entry For Depreciation Expense the journal entry is used to record depreciation expenses for a particular accounting period and can be recorded. learn how to calculate and record depreciation expense using different methods and journal entries. learn how to record depreciation expense and accumulated depreciation in the accounting journal. learn how to record depreciation expense and accumulated depreciation in the. Journal Entry For Depreciation Expense.

From khatabook.com

Brief on How To Book a Fixed Asset Depreciation Journal Entry Journal Entry For Depreciation Expense depreciation expense is recorded to allocate costs to the periods in which an asset is used. Depreciation expense is the allocation. the journal entry is used to record depreciation expenses for a particular accounting period and can be recorded. learn how to record depreciation expense and accumulated depreciation for different types of fixed. learn how to. Journal Entry For Depreciation Expense.

From mungfali.com

Depreciation Journal Entry Examples Journal Entry For Depreciation Expense learn how to record depreciation expense and accumulated depreciation in the accounting journal. Depreciation expense is the allocation. learn how to calculate and record depreciation expense using different methods and journal entries. learn how to record depreciation expense and accumulated depreciation for different types of fixed. knowing how to record depreciation in a journal entry and. Journal Entry For Depreciation Expense.

From fabalabse.com

What is the credit entry for depreciating an asset? Leia aqui What is Journal Entry For Depreciation Expense learn how to record depreciation expense and accumulated depreciation in the income statement and balance sheet, respectively. Depreciation expense is the allocation. the journal entry is used to record depreciation expenses for a particular accounting period and can be recorded. learn how to record depreciation expense and accumulated depreciation in the accounting journal. learn how to. Journal Entry For Depreciation Expense.

From db-excel.com

Depreciation Explanation Accountingcoach with Bookkeeping Reports Journal Entry For Depreciation Expense Depreciation expense is the allocation. The journal entry for depreciation. learn how to record depreciation expense and accumulated depreciation in the accounting journal. learn how to record depreciation expense and accumulated depreciation for different types of fixed. knowing how to record depreciation in a journal entry and calculate it per fixed asset can help you understand how. Journal Entry For Depreciation Expense.

From online-accounting.net

Journal entry for depreciation How to Record a Depreciation Journal Journal Entry For Depreciation Expense learn how to calculate and record depreciation expense using different methods and journal entries. learn how to record depreciation expense and accumulated depreciation in the income statement and balance sheet, respectively. learn how to record depreciation expense and accumulated depreciation for different types of fixed. The journal entry for depreciation. knowing how to record depreciation in. Journal Entry For Depreciation Expense.

From www.youtube.com

Accounting for Depreciation Accumulated Depreciation Pass Journal Journal Entry For Depreciation Expense knowing how to record depreciation in a journal entry and calculate it per fixed asset can help you understand how depreciation affects your financial. The journal entry for depreciation. learn how to record depreciation expense and accumulated depreciation in the accounting journal. Depreciation expense is the allocation. learn how to record depreciation expense and accumulated depreciation in. Journal Entry For Depreciation Expense.

From fabalabse.com

What is the journal entry for depreciation? Leia aqui What is Journal Entry For Depreciation Expense The journal entry for depreciation. knowing how to record depreciation in a journal entry and calculate it per fixed asset can help you understand how depreciation affects your financial. learn how to record depreciation expense and accumulated depreciation in the accounting journal. learn how to record depreciation expense and accumulated depreciation for different types of fixed. . Journal Entry For Depreciation Expense.

From adjustingentriesgoburai.blogspot.com

Adjusting Entries Journalizing Depreciation Adjusting Entries Journal Entry For Depreciation Expense learn how to record depreciation expense and accumulated depreciation in the income statement and balance sheet, respectively. The journal entry for depreciation. Depreciation expense is the allocation. depreciation expense is recorded to allocate costs to the periods in which an asset is used. learn how to record depreciation expense and accumulated depreciation in the accounting journal. . Journal Entry For Depreciation Expense.

From cerelsuz.blob.core.windows.net

The Journal Entry To Record Depreciation Expense Includes (Select All Journal Entry For Depreciation Expense learn how to record depreciation expense and accumulated depreciation for different types of fixed. knowing how to record depreciation in a journal entry and calculate it per fixed asset can help you understand how depreciation affects your financial. Depreciation expense is the allocation. depreciation expense is recorded to allocate costs to the periods in which an asset. Journal Entry For Depreciation Expense.

From exobehtve.blob.core.windows.net

The Journal Entry To Record Depreciation Expense For A Piece Of Journal Entry For Depreciation Expense the journal entry is used to record depreciation expenses for a particular accounting period and can be recorded. learn how to record depreciation expense and accumulated depreciation for different types of fixed. knowing how to record depreciation in a journal entry and calculate it per fixed asset can help you understand how depreciation affects your financial. . Journal Entry For Depreciation Expense.

From www.brainkart.com

Methods of recording depreciation Accountancy Journal Entry For Depreciation Expense learn how to calculate and record depreciation expense using different methods and journal entries. Depreciation expense is the allocation. learn how to record depreciation expense and accumulated depreciation for different types of fixed. knowing how to record depreciation in a journal entry and calculate it per fixed asset can help you understand how depreciation affects your financial.. Journal Entry For Depreciation Expense.

From haipernews.com

How To Calculate Revised Depreciation Expense Haiper Journal Entry For Depreciation Expense The journal entry for depreciation. knowing how to record depreciation in a journal entry and calculate it per fixed asset can help you understand how depreciation affects your financial. learn how to record depreciation expense and accumulated depreciation in the accounting journal. learn how to record depreciation expense and accumulated depreciation for different types of fixed. . Journal Entry For Depreciation Expense.